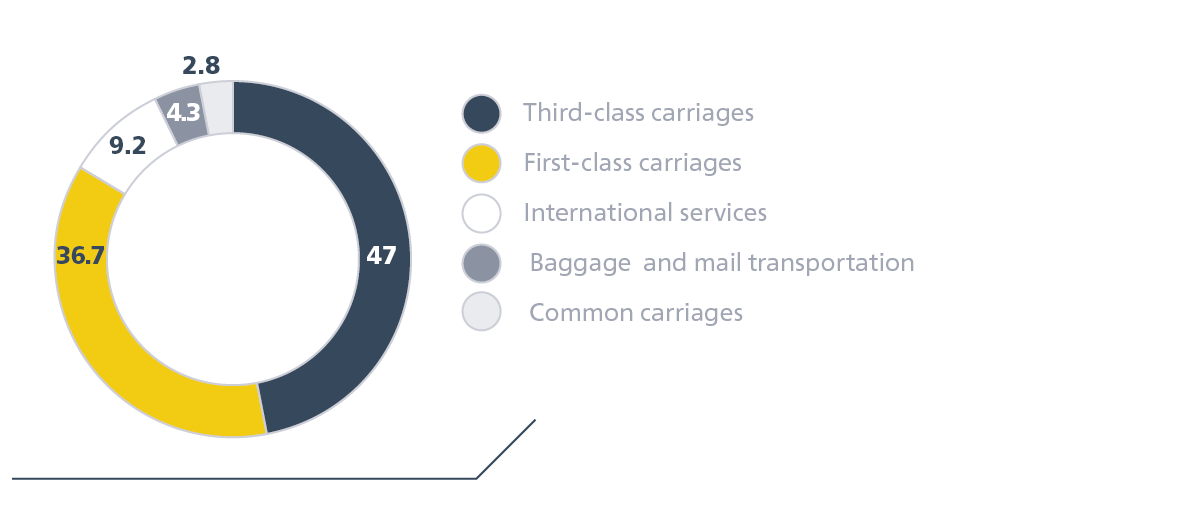

In 2015, revenue from passenger services amounted to RUB 160.0 billion, down 2.6% year-on-year.

Revenue in the deregulated segment was RUB 73.9 billion, down 6.8% year-on-year.

Domestic traffic generated the revenue of RUB 58.5 billion. A 1.6% decrease on the previous year was due to a 9.9% decline in passenger turnover in the segment and fare indexation by 5%.

A decline in international traffic both on the Company’s trains (down 55.1% year-on-year) and trains made up in the CIS and Baltic states (down 30.3% year-on-year), including due to cancellation of FPC trains running to Ukraine, led to a decline in international passenger revenue by 22.4% year-on-year.

Revenue in the regulated segment totalled RUB 86.1 billion, up 1.4% year-on-year.

Revenue from passenger services in third-class and common carriages reached RUB 79.2 billion. A 3.1% growth year-on-year was due to the fare indexation by 10%, while passenger turnover in this segment declined by 3.3%.

Revenue from baggage, unaccompanied baggage, and mail transportation totalled RUB 6.9 billion. A 15.3% decrease vs 2014 level was due to a decline in baggage and unaccompanied baggage turnover in the Company’s own and leased baggage carriages by 37.8% year-on-year and tariff indexation by 10%.